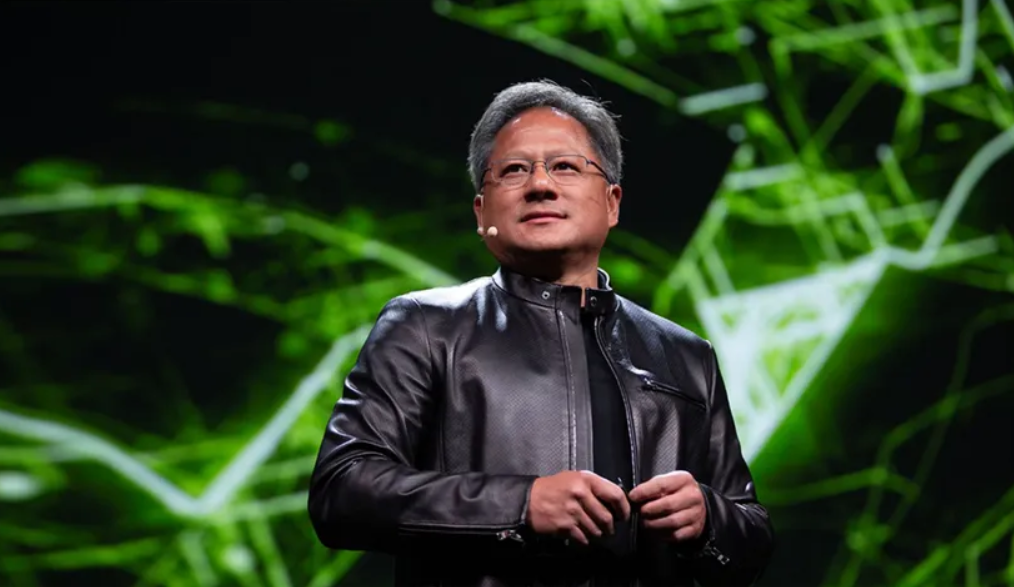

On Wednesday 6-July Nvidia stock jumped and pushed the company past a $4 trillion market cap in intraday trading for the first time ever. The California-based company, which was founded in 1993, first passed the $2 trillion mark in February 2024, and surpassed $3 trillion in June. What makes this number staggering is not just the valuation, but what it represents. $4 trillion is equivalent to India’s entire GDP — the economic output of 1.4 billion people in a developing superpower, now mirrored by the valuation of one chip company.

NVIDIA dominates GPUs, the backbone of AI training. Their chips are what run OpenAI, Google DeepMind, autonomous vehicles, scientific models—everything. where India’s GDP comes from agriculture, services, manufacturing, infrastructure—real-world activity. NVIDIA’s value is hyper-concentrated digital leverage. Companies creating AI infrastructure (like NVIDIA, OpenAI, Anthropic) are becoming the new economic superpowers.

Today, Nvidia dominates the AI infrastructure race:

- 80%+ of all AI model training runs on NVIDIA hardware (A100, H100, now B100 chips)

- Their chips power systems used by OpenAI, Google DeepMind, Meta, and Tesla

- CUDA (NVIDIA’s proprietary parallel computing platform) is now a near-monopoly standard for AI developer

In contract- India’s economy is one of the most diverse on Earth:

- 60% of GDP: Services (IT, finance, retail, healthcare)

- 15%+: Manufacturing (automobiles, steel, textiles)

- ~18%: Agriculture (the backbone of rural livelihood)

- Demographic Powerhouse: Over 500 million working-age citizens

NVIDIA’S CAGR (Compound Annual Growth Rate): ~75% over 5 years, where India’s CAGR: ~8% over 5 years- This is a healthy, realistic rate for a developing economy. So how does a company with ~30,000 employees match a country of 1.4 billion people? The answer: computational leverage.

For countries like India, the challenge is clear: embrace compute, build sovereign AI infrastructure, and invest in deep tech — or risk being digitally colonized by the world’s new empires. This isn’t just a race for capital. It’s a race for control over tomorrow’s intelligence.

What Drives India’s GDP?

| Sector | Contribution to GDP | Factors |

|---|---|---|

| Services Sector | ~60% | Dominated by IT, telecom, finance, real estate, and trade |

| Manufacturing | ~15–17% | Includes auto, electronics, chemicals; goal: 25% by 2025 |

| Agriculture | ~17–18% | Employs ~42% of workforce; highly dependent on monsoons |

| Exports & Trade | ~20% of GDP | $775B in exports (2023–24), led by software, pharma, gems |

| Domestic Consumption | ~58–60% of GDP | India has a strong consumer-driven economy |

| Infrastructure Spending | ~5.5% of GDP | Target: $1.4T investment through National Infrastructure Pipeline |

| Tech & Innovation (AI, Space, etc.) | <1.5% | Nascent but high-potential segment; under-leveraged |

key factors India must influence to secure long-term economic strength, and why they are neglected despite urgency.

1. Deep-Tech Infrastructure

Why It Must Be Influenced:

- Global economy is shifting to compute and intelligence (not just services).

- Nations that own their compute stack (chips, data centers, cloud, algorithms) will dominate in security, innovation, and GDP.

- AI chip shortage is a real threat. India doesn’t produce high-end GPUs or fabs.

- Without investment here, India becomes a client state of AI empires (like NVIDIA, OpenAI, Google).

Why It’s Neglected:

- Lack of political understanding: policy often treats AI as “IT upgrade,” not infrastructure.

- High upfront cost with long-term, non-vote-winning payoff.

- India has no advanced semiconductor ecosystem (despite promises like Semicon India).

- Reliance on imported tech is easier — short-term, but deadly long-term.

2. Public Research and Innovation Funding

Why It’s Critical:

- All major tech revolutions (Internet, GPS, vaccines, AI) started with publicly funded R&D.

- India spends <1% of GDP on R&D, while China spends ~2.4%, US ~3.4%.

- Without R&D, India is stuck buying or replicating rather than leading.

- Future GDP will depend on IP creation, not cheap labor.

Why It’s Not Taken Seriously:

- R&D returns are slow, abstract, and not “mass-appeal” for elections.

- Bureaucratic systems under CSIR/DRDO/IITs are often rigid and underfunded.

- Startup funding is private-sector dominated — few public moonshot projects.

4. Tech-Enabled Manufacturing

Why It’s Crucial:

- Manufacturing needs a quantum leap — not just “Make in India,” but Smartly Make in India.

- With IoT, robotics, and AI, India could be a hub of precision exports, not just assembly.

- Could upskill rural + semi-urban workforce with modern tools.

Why It’s Missed:

- MSMEs (who form bulk of India’s manufacturing) have low digitization.

- Policy focus is on scale, not smartness.

- Supply chain inefficiencies, logistics bottlenecks, and legacy mindsets dominate.

Computing is not the only economic currency — what does history tell us about how global ‘currencies’ of power change?

| Era | Global Currency of Power | Who Dominated |

|---|---|---|

| 18th–19th Century | Industrialization (coal, steel) | Britain, then Germany |

| 20th Century | Oil & Heavy Manufacturing | USA, Soviet Union, OPEC |

| Late 20th | Electronics & Software | USA (Silicon Valley), Japan |

| Early 21st | Data, Internet & Platforms | USA (GAFAM), China (BAT) |

| Now & Next | Compute + AI + Space + Sovereign Tech | Emerging: USA, China, UAE, etc. |

So what should India do now?

India needs to stop reacting and start anticipating.

We don’t need to catch up — we need to leap ahead, by owning the next tech currency before it dominates.

That means not just buying chips or smartphones, but designing, engineering, and manufacturing everything — and doing it well.

| Sector | Why It Matters | Where India Stands | What’s Missing |

|---|---|---|---|

| Space Tech | National pride, defense, satellite economy | ISRO is world-class | Private scale, reusable systems, interplanetary focus |

| Aviation (Drones to Aerospace) | Urban mobility, military, global tech exports | Growing (Garuda, HAL) | No original aerospace platform like Boeing/Airbus |

| Supercomputing | Weather, defense, AI training | PARAM series | Not commercial, lacks GPU fab |

| Consumer Electronics | Everyday control, tech nationalism | Mostly assembly (not design or IP) | Chip design, OS, ecosystem ownership |

| Automobile (EVs) | Global shift to electric; $1T+ industry | Tata, Ola Electric | Lacks deep battery innovation, global brand recognition |

| Manufacturing | Jobs + GDP boost | 15–17% GDP, growing | Needs robotics, automation (Industry 4.0) |

| Scientific Research | Long-term innovation source | Decent base (IITs, CSIR) | Needs better funding, speed, and freedom |

What Will It Take to Flip This?

- Massive investment in national tech labs — like India’s DARPA

- Foundational industry building — not just startups, but chip fabs, robotics hubs, etc.

- Mandatory public-private partnerships in R&D

- Tech patriotism — policies that promote buying local (with quality)

- World-class product design labs + branding strategy

You can’t just make a phone. You have to make people want it more than a Samsung or Apple. That takes reliability, identity, and pride.

And Reliability Comes from Research

If we want Indian products to be trusted, they must be backed by great science. That means:

- Testing, failure, iteration

- Long research cycles

- Strong university–industry links

- Freedom to explore, fail, and invent

Without that? We remain a market. With it? We lead the next era.

That should be Doctrine of Innovation